Schedule & Shows

- George Galloway interview

- Roger Stone: Monday at 530 eastern

- Bourbon w/ Barnes: Monday & Thursday at 9 pm eastern

- Sidebar: Eric July, Wednesday at 7 p.m. eastern

- Closing Argument: The Death of the Dollar Is Greatly Exaggerated

Introduction: Top Headlines

- Savings fall, credit cards spiked, millennials borrowed record amount Q4 of 2222.

- Credit continues to shrink, corporate real estate troubles, record level drawdown in US bonds.

- Bears’ bets rise, Apple struggles, volatility rises, consumers expect less credit & higher prices.

- Trump now leads even in Florida.

- More 1/6 informants outed.

- Ukraine leaked docs show flaws in war strategies.

- Muslim nations distrust US.

- Putin record approval in America, with his strongest support from MAGA millennial men.

- Barr signals to Deep State to indict Trump in docs issue due to NY indictment weakness.

- John Wick, Mario Bros., Scream sequels show public interest in non-woke films as Marvel fails.

Wisdom of the Day: “Lesson: In the real world, ninety-nine cents will not get you into New York City. You will need the full dollar.”

Evidence: Top 10 Articles of Curated Library

- Archives lying about Trump doc history. https://justthenews.com/government/federal-agencies/internal-memos-call-question-national-archives-narrative-congress-trump

- China’s debt problem: in dollars. https://www.bostonfed.org/news-and-events/news/2022/12/china-dollar-funding-denominated-debt-spillover-effects-leslie-shen-boston-fed.aspx

- Board member post: understanding AKs. https://vivabarneslaw.locals.com/post/3826511/per-a-request-by-mightypaix-here-is-the-commentary-i-posted-during-the-sunday-lifestream-providing

- Why statute of limitations bars Trump indictment. https://thefederalist.com/2023/04/10/yes-the-statute-of-limitations-has-passed-on-braggs-get-trump-case/

- Lost treatise decrypted. https://www.jpost.com/archaeology/article-738848

- Fed doesn’t want full-reserve banking, unless it’s FedCoin CDBC.

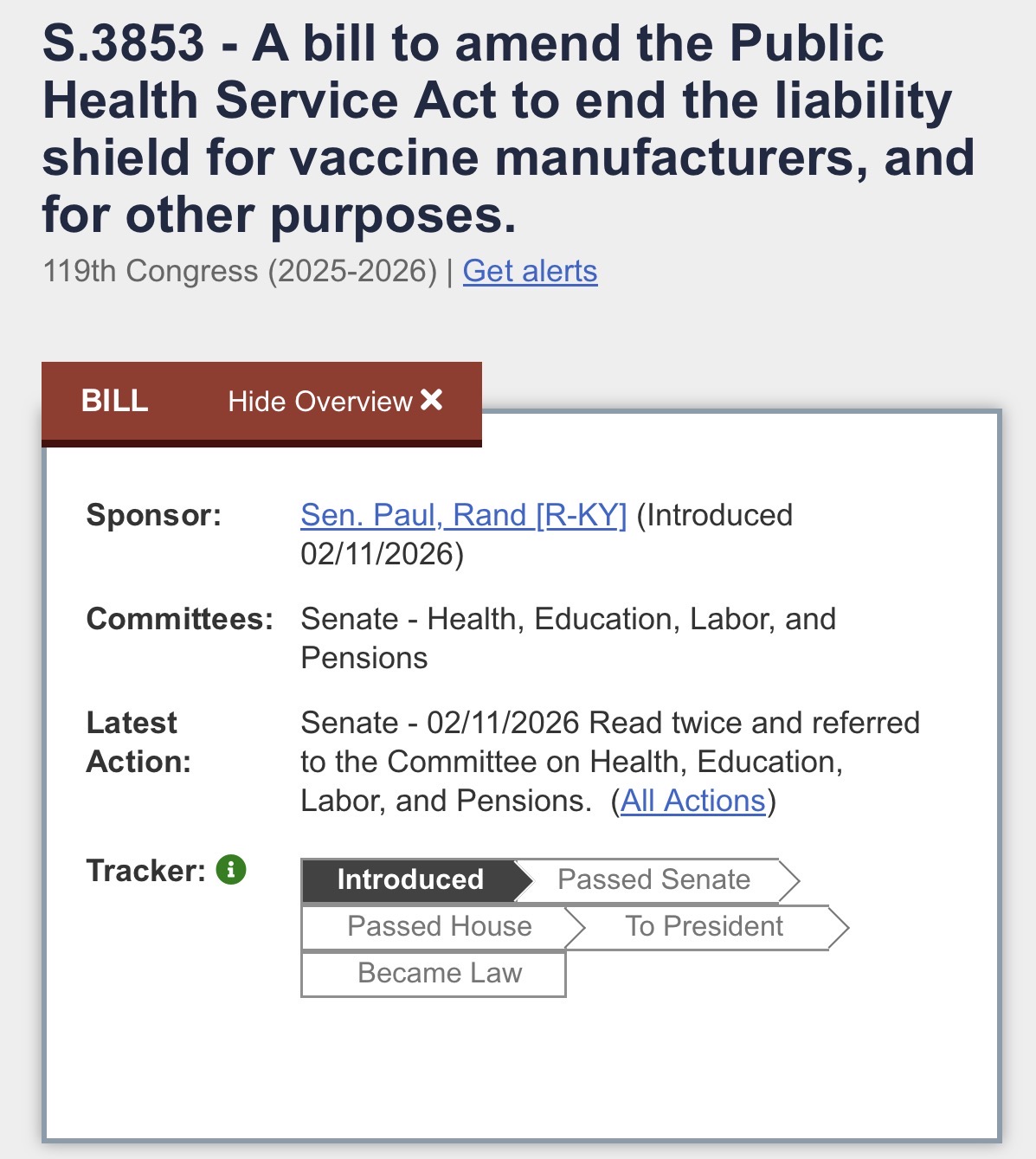

- Politico covers our Covid cases. https://www.politico.com/news/magazine/2023/04/09/anti-vax-covid-litigation-00090939

- Trump indictment incoherent: https://spectator.org/the-incoherent-trump-indictment/

- Another good summation of Snider Eurodollar thesis. https://www.rmillertradingeconomics.com/blog/its-all-lies-part-2b-the-money-supply-metrics-have-become-obsolete

- Why China peaked. https://www.ekathimerini.com/opinion/1206916/why-china-has-passed-its-economic-growth-peak/

*Bonus: Rescued dog. https://news.maryland.gov/msp/2023/04/10/maryland-state-police-aviation-rescue-hiker-dog/

Closing Argument

- Before World War 1, the British pound held more than half of all reserves. The newly issued U.S. Dollar had no international reserve presence. World War 1 changed that. By end of the war, the British pound still dominated, but the U.S. Dollar quickly replaced the other competitors, surging rapidly to nearly 25% of the world’s reserves. By 1922, the dollar surged past the pound, and they would flip-flop lead positions for the next two decades. By the end of the 1920’s, the dollar held a majority reserve currency status, which then switched to the pound during the 1930s. Before World War 2, the pound surged back to a dominant role in reserve currencies, with a 3 to 1 edge over the dollar. It took until the middle of the 1950s for the dollar to take back the reserve currency status, which it held and surged in the 1960s. By 1970, the rise of the EuroDollar, often domiciled in London, led to abandoning the British pound, such that by the 1970s, the pound barely broke double digits in reserve currencies.

- The next challenger, the Euro, rose to compete with the dollar in the 1980s, reducing the dollar to around 50% of reserve currency status until the 90’s surge in EuroDollar lending brought the dollar back to nearly two-thirds status. The GFC shrink that to around 60%, but the Euro has never proven a real competitor.

- The smaller competitors never took off. The Yen rose to nearly 10% in the 1980s, but has never broke double digits, and hovers around 5% today in it’s 4th decade of lethargic economy. Of note, the Chinese yuan has never competed, barely breaking 3% ever in this time period. Contrary to Ray Diallo’s assumptions, the yuan has not followed the dollar’s path as its trade boomed, and indicators suggest China’s economic power may be flatlining.

- In 2006, China’s exports made up 36% of GDP; today, about half that. Various studies suggest China’s actual GDP is 40% less than the official data. Top-down, state-controlled economies struggle with innovation, essential to continued growth. This flawed system produced unproductive lending creating bubbles in real estate, dubious infrastructure projects, and other affiliated unproductive sectors of the economy. Much of China’s debt, including its Belt & Road initiative lending to foreign nations, is actually denominated mostly in dollars, not yuan. China’s banks and corporations often borrow in dollars as well. The promise of settlements in a China-driven BRICS currency basket faces the big problem that China wants to control its currency, limit capital flight of its currency, and prices its own exports and imports, like much of the debt, in dollars. There is also almost no evidence that foreign importers (outside Russia) to China want yuan or that everyday folks want to transact in yuan.

- Even aside from the Snider theory of EuroDollar bank-controlled currency and its role in global funding, the dollar dominance in global markets at every level – daily forex exchange transactions, trade, debt, assets, at the individual, corporate and sovereign level – show the dollar is going nowhere soon. Nearly 90% of all daily currency transactions need the dollar. An estimated $100 trillion of global balance sheets denominate their assets and debt in dollars. Many foreign nations also borrowed in dollars over the last decade. Worries about loss of reserve status look quite misplaced.