I. INTRODUCTION

I sure hope and pray that JD gets a chance to lead our country after this Trump administration… hearing him speaking at the March for Life in Washington he already seems more presidential than Trump .

I did a quick hit on Richard Syrette yesterday. Gotta keep Canadians apprised of the U.S. madness.

I. INTRODUCTION

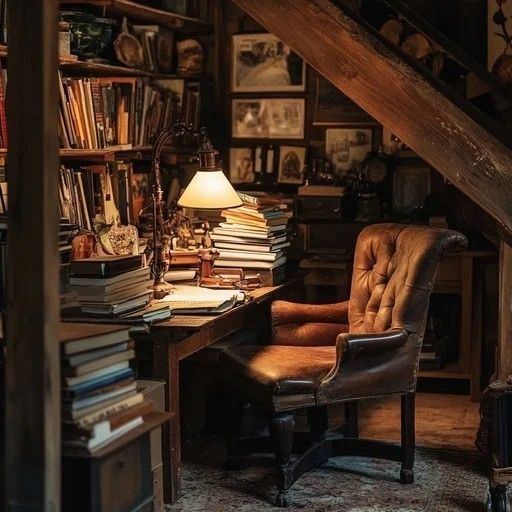

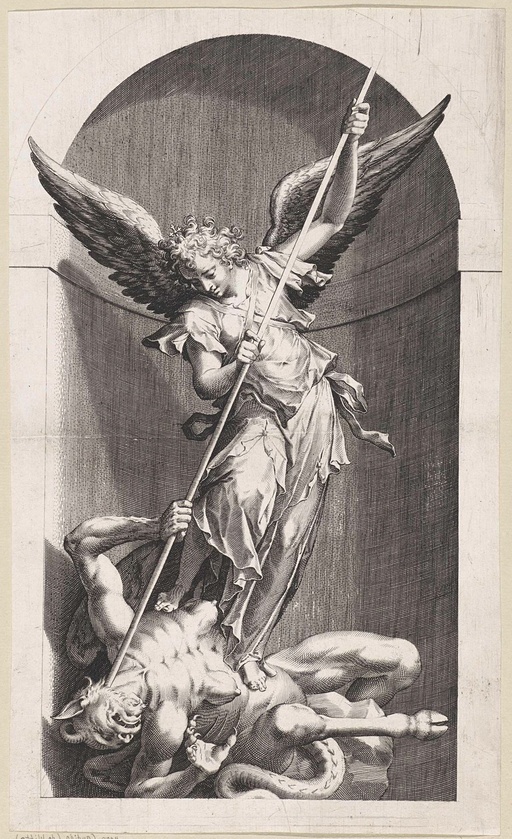

A. Art of the Week

B. Recommendation of the Week

C. Wisdom of the Week

D. Appearances

II. THE EVIDENCE

A. Barnes Library: Curated Weekly Articles of Interest

*Bonus: Bald eagle rescued. https://abc7ny.com/post/nypd-officers-describe-rare-rescue-trapped-american-bald-eagle-icy-hudson-river-nyc/18616678/

B. Best of the Board: Five Fantastic Posts of the Week

*Bonus: Bondi mockery. https://vivabarneslaw.locals.com/post/7703469/spotted-all-over-washington-dc-while-i-normally-don-t-share-the-political-views-of-people-in-dc

**Bonus: Weekly Wisdom. https://vivabarneslaw.locals.com/post/7704649/the-intersection-of-politics-youtube-commentary-and-critical-traffic-infrastructure-https-you

C. Homework: Cases of the Week for Sunday

*Lobbyist disclosure laws. https://www.law.cornell.edu/uscode/text/2/chapter-26

**Lobbying disclosure guidelines. https://www.senate.gov/legislative/resources/pdf/S1guidance.pdf

***Transanity in Canada. https://vivabarneslaw.locals.com/post/7704549/tribunal-ruling-out-of-british-columbia-canada

III. CLOSING ARGUMENT: Constitution Masterclass Series — Article I, Tariffs

I. INTRODUCTION

A. Art of the Week

B. Recommendation of the Week

C. Wisdom of the Week

D. Appearances

II. THE EVIDENCE

A reminder: links are NOT endorsements of the authors or their interpretation of events, but intended to expand our library of understanding as well as expose ideas of distinct perspective to our own.

A. Barnes Library: Ten of the Top Curated Weekly Articles

B. Homework: Cases of the Week for Sunday

*Bonus: Livenation Ticketmaster Antitrust https://www.hollywoodreporter.com/music/music-industry-news/live-nation-doj-lawsuit-after-gail-slater-resignation-1236504011/

**Bonus: NCAAF eligibility suit. https://www.knoxnews.com/picture-gallery/sports/college/university-of-tennessee/football/2026/02/13/joey-aguilar-eligibility-hearing-tennessee-vs-ncaa/88659399007/

***Bonus: AI plagiarism win. https://www.newsday.com/long-island/education/adelphi-university-ai-plagiarism-lawsuit-oh07enyz

C. Best of the Board: Ten of the Top Posts

III. CLOSING ARGUMENT: Constitution Masterclass Series — Article I, Elections