Spain’s National Court Upholds Extradition of Bitcoin Pioneer Roger Keith Ver to the United States

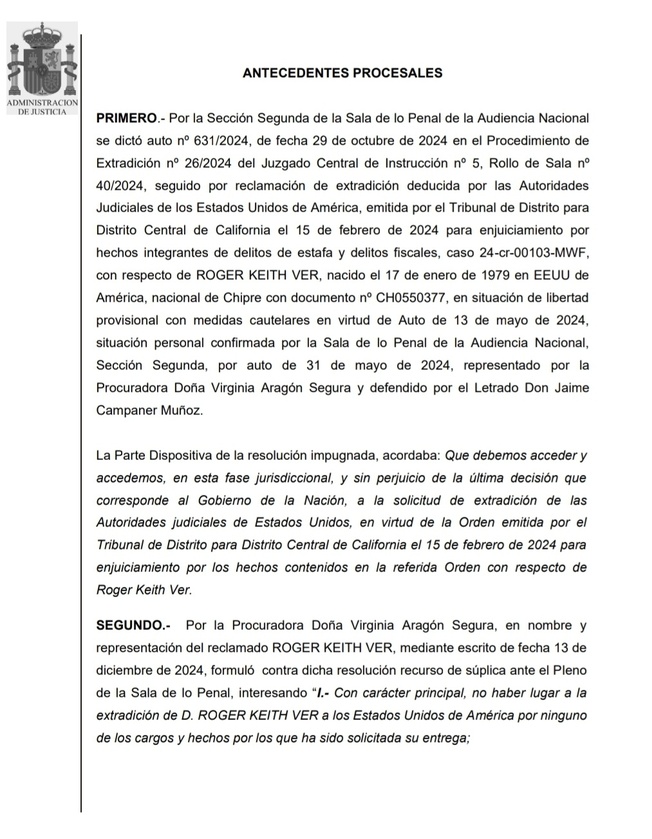

In a landmark decision that could set a precedent for future cases involving cryptocurrency-related crimes, Spain’s Audiencia Nacional has dismissed the appeal filed by Roger Keith Ver, a prominent figure in the Bitcoin community, against his extradition to the United States. The ruling, delivered by the Plenary of the Criminal Chamber on February 4, 2025, reaffirms an earlier decision to extradite Ver to face multiple charges of tax fraud and financial crimes. This development marks a significant chapter in the international legal pursuit of financial misconduct in the digital age.

Background of the Case: The Fall of "Bitcoin Jesus"

Roger Keith Ver, often referred to as "Bitcoin Jesus" due to his early advocacy and investment in Bitcoin, is a dual national of the United States and Cyprus. Born in California on January 17, 1979, Ver rose to prominence in the tech world as the CEO and sole proprietor of MemoryDealers.com, Inc. and Agilestar.com, Inc., two companies based in Santa Clara, California, that specialized in selling networking equipment and computer hardware. Ver was an early adopter of Bitcoin, beginning to accumulate the cryptocurrency as early as April 2011, both for personal use and through his companies.

In 2014, Ver renounced his U.S. citizenship after obtaining citizenship from the Caribbean nation of Saint Kitts and Nevis, a move that triggered obligations under U.S. tax laws, specifically the expatriation tax. The case against Ver hinges on allegations that he failed to fulfill these tax obligations by concealing significant Bitcoin holdings and underreporting the value of his companies during the expatriation process.

The U.S. Department of Justice, through the District Court for the Central District of California, issued an extradition request on February 15, 2024. The request accuses Ver of defrauding the Internal Revenue Service (IRS) by failing to declare substantial gains from the sale of cryptocurrencies and corporate assets, actions that resulted in an estimated $48 million in unpaid taxes.

Legal Proceedings in Spain

Following his arrest in Spain, Ver was placed under provisional release with precautionary measures in May 2024. He was represented by Procuradora Virginia Aragón Segura and defended by attorney Jaime Campaner Muñoz. On October 29, 2024, the Audiencia Nacional’s Second Section of the Criminal Chamber issued Auto No. 631/2024, agreeing to the extradition of Ver to the United States, pending final approval from the Spanish government.

In response, Ver’s legal team filed a recurso de súplica (appeal) on December 13, 2024, seeking to overturn the extradition order. The appeal requested, primarily, that the court deny the extradition entirely. Alternatively, they sought to limit the extradition to specific charges related to Ver’s 2017 personal income tax declaration, contingent upon assurances from U.S. authorities that Ver would not be prosecuted for any additional offenses not explicitly mentioned in the extradition request—a principle known as "specialty."

The appeal also proposed, as a last resort, that the Audiencia Nacional refer the case to the European Court of Justice (ECJ) for a preliminary ruling on whether the extradition violated European Union laws, particularly concerning the protection of EU citizens from potential legal abuses in third countries like the United States.

The Allegations: A Complex Web of Cryptocurrency and Tax Fraud

The U.S. extradition request and the subsequent Spanish legal proceedings center around several key allegations against Ver:

1. Failure to Declare Bitcoin Holdings During Expatriation (2014):

Upon renouncing his U.S. citizenship in 2014, Ver was legally obligated to declare all his worldwide assets, including capital gains from what is known in U.S. tax law as a "fictitious sale" of his assets the day before expatriation. At the time, Ver reportedly owned approximately 131,000 Bitcoins, valued at hundreds of millions of dollars, either directly or through his companies. Instead of declaring these holdings, Ver allegedly submitted a 2014 expatriation tax return (Form 8854) that falsely stated he did not own any Bitcoins and significantly undervalued his businesses.

2. Misrepresentation in 2017 Personal Income Tax Return:

In 2017, Ver allegedly removed all Bitcoin holdings from his companies' balance sheets and sold a significant portion of them, transferring approximately $240 million in proceeds to personal bank accounts in the Bahamas. When questioned by his tax preparers about any income or distributions from MemoryDealers.com and Agilestar.com, Ver reportedly denied receiving any, resulting in the omission of these transactions in his 2017 U.S. personal income tax return (Form 1040NR).

3. Total Estimated Tax Evasion:

The cumulative effect of these alleged actions resulted in the defrauding of the IRS to the tune of $48 million in unpaid taxes from both his expatriation and subsequent financial dealings.

Arguments Raised in Ver’s Appeal

Ver’s defense team presented multiple arguments in an attempt to block or limit his extradition. However, each argument was systematically rejected by the Audiencia Nacional in its detailed ruling.

1. Violation of Legal Procedures and Rights:

The defense argued that the extradition violated Ver's fundamental rights, including his right to a fair trial, the right to effective judicial protection, and the principle of legal certainty. They claimed that at the time of the alleged offenses, particularly in 2014, there was no clear guidance from the IRS regarding the taxation of cryptocurrencies. They cited an opinion by U.S. tax expert Jason Schwartz, who argued that clear tax regulations on Bitcoin were not established until 2019.

2. Lack of Double Criminality:

The defense contended that the crimes Ver is accused of do not have an equivalent under Spanish law, a requirement known as double criminality for extradition cases. Specifically, they argued that the U.S. expatriation tax, which taxes the loss of citizenship, has no direct counterpart in Spain, where taxes typically focus on changes in residency rather than nationality. The court, however, found this argument unconvincing, pointing to Spain’s exit tax (Impuesto de Salida), which applies to individuals moving their tax residence abroad and similarly aims to prevent tax evasion on unrealized capital gains.

3. Political Persecution Claim:

Ver claimed that his extradition was politically motivated, alleging that U.S. authorities targeted him because of his libertarian views, criticism of U.S. fiscal policies, and advocacy for cryptocurrencies as an alternative to government-issued currencies. He cited several incidents, including the timing of his arrest shortly after publishing a critical book titled Hijacking Bitcoin: The Hidden History of BTC. Ver also referenced a prior conviction for selling agricultural fireworks and the denial of his U.S. visa on two occasions as evidence of political bias.

The court firmly rejected this claim, stating that the charges were strictly related to financial crimes and that there was no evidence suggesting the extradition was politically motivated. The ruling emphasized that Ver’s personal beliefs or political opinions did not exempt him from complying with tax laws.

4. Concerns Over U.S. Legal Compliance with the Principle of Specialty:

Ver’s legal team expressed concerns that U.S. authorities might violate the principle of specialty, which prohibits prosecuting an extradited individual for crimes other than those specified in the extradition request. They cited the U.S. case United States v. Suarez and several German court rulings that questioned the U.S.'s adherence to this principle. However, the Spanish court dismissed these concerns, citing longstanding bilateral agreements between Spain and the U.S., and emphasizing the principle of mutual trust in international law, which assumes that treaty obligations will be honored by both parties.

The Court’s Rationale and Final Decision

The Audiencia Nacional meticulously addressed each of the arguments presented in Ver's appeal, ultimately rejecting them all. The court highlighted several key points in its decision:

-

Adherence to International Legal Standards:

The court emphasized that the extradition process is not designed to assess the guilt or innocence of the individual but to determine whether legal criteria for extradition are met. The court found that the U.S. had provided sufficient evidence and legal justification for the extradition.

-

Existence of Double Criminality:

The court affirmed that the alleged tax offenses, including the concealment of assets and fraudulent tax declarations, would constitute crimes under both U.S. and Spanish law, satisfying the requirement of double criminality.

-

Rejection of Political Motivation Claims:

The court found no evidence to support Ver’s claims of political persecution, stating that the charges were based on clear legal violations and not his political views or public statements.

-

No Need for Additional Guarantees from the U.S.:

The court ruled that existing bilateral treaties between Spain and the U.S. provided sufficient safeguards to ensure Ver would not be prosecuted for additional crimes beyond those listed in the extradition request.

The final ruling states:

"Desestimar el recurso de súplica formulado por la Procuradora Doña Virginia Aragón Segura, en nombre y representación del reclamado Roger Keith Ver, asistido por el Letrado Don Jaime Campaner Muñoz. Se confirma en su integridad dicha resolución, por la que se acordaba acceder en esta fase jurisdiccional, y sin perjuicio de la última decisión que corresponde al Gobierno de la Nación, a la solicitud de extradición de las Autoridades judiciales de Estados Unidos."

Implications and Next Steps

While the court's decision paves the way for Ver's extradition, the final approval rests with the Spanish government. The case underscores Spain’s commitment to international legal cooperation, particularly with the United States, in addressing complex financial crimes involving digital currencies.

For Ver, the ruling represents a significant legal setback and a cautionary tale for others navigating the evolving landscape of cryptocurrency regulation. As authorities worldwide tighten their grip on financial crimes in the digital realm, the case of Roger Keith Ver may well serve as a pivotal moment in the intersection of international law, technology, and finance.